LAWYER: How to Pay Yourself From An LLC The RIGHT Way

Автор: Real Estate Law Guys I Asset Protection

Загружено: 2025-06-21

Просмотров: 1192

Описание:

✅ Get YOUR Special Offer To Set Up Your LLC & Asset Protection NOW!

https://appointment.strlawguys.com/sc...

PICK UP JEFF'S BEST-SELLING BOOK ON ASSET PROTECTION AT AMAZON:

https://a.co/d/3zC1Wx3

Free Guides:

5 Best Protection Strategies: https://www.strlawguys.com/5-strategi...

Example of Asset Protection Plan: https://www.strlawguys.com/a-case-stu...

Ultimate Guide to Short-Term Rental Insurance: https://www.strlawguys.com/the-ultima...

HOW TO PAY YOURSELF FROM AN LLC THE RIGHT WAY

"If you just formed your LLC, and you're paying yourself by transferring random amounts to your personal account… You’re not only doing it wrong — you might be setting yourself up for tax penalties, audits, and major headaches later."

"But don’t worry — I’m going to show you exactly how to fix it."

If you just started an LLC and you’re wondering... "How do I actually pay myself?"

You’re not alone. And yes, this stuff feels confusing.

I remember when I launched my first law firm back in 2005. I’d always had a paycheck. Clock in, clock out, money just showed up. But now I was the business. I had clients, income, expenses — and zero idea what I could take home.

I didn’t want to mess it up. And you probably don’t either.

So today I’m going to walk you through a dead-simple, 3-level system for how to pay yourself from your LLC — legally, smartly, and in a way that actually scales as you grow.

Let’s break it down.

So, Level 1. You just formed your LLC. You have no income yet. Maybe you’re freelancing on the side. Maybe you’re full-time building this thing from scratch.

And you're thinking: *"Can I pay myself yet?"

The answer? Not really.

At this stage, you’re not pulling money out — you’re putting money in.

Think of it like planting a garden. You don’t eat the tomatoes in week one. You buy seeds, build a fence, dig the soil. You invest. That’s what this phase is.

Now here’s the critical part most people get wrong: They mix personal and business money.

Do. Not. Do. That.

If you buy groceries with your business debit card, or pay your LLC expenses from your personal checking account, you’re creating a mess for your accountant and for the IRS.

Instead:

Open a business bank account

Transfer in your startup money as either a contribution or a loan

Only pay business expenses from that business account

It’s tempting to shortcut this part, but trust me — it sets the tone for everything that follows.

Level 2 is where the business starts making money. Maybe you’re earning $2k/month. Maybe $4k. Let’s say up to $50k/year in net profit.

You’re wondering: *"Should I become an S Corp? Should I hire a bookkeeper? Should I be on payroll?"

Hold up. You don’t need an S Corp yet. In fact, at this level, the cost of forming and maintaining an S Corp usually outweighs the tax savings.

Here’s what I do recommend:

Use the Profit First system. This changed the game for me.

Quick analogy: Think of your business like a pizza. Without slices, you just eat from the middle until it’s gone. Profit First gives you slices. It tells you where every dollar should go.

How do you actually pay yourself? Write yourself a check from the Owner’s Pay account. Deposit it into your personal bank account. Pay your personal bills from there.

Don’t pay personal expenses from your business card. Don’t deposit client checks into your personal account. Keep it clean.

Pro tip? I keep my personal and business accounts at different banks. Makes it harder to mess this up.

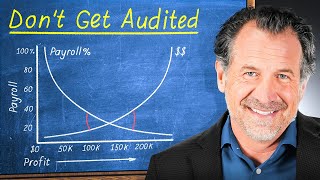

Okay — Level 3 is where the real tax savings start.

At this point, you’re making more than $50,000 in net profit. You’ve got traction. You’ve got consistency. Now it’s time to start thinking about an S Corp election.

Here’s why it matters: As a regular LLC, all your profits are subject to self-employment tax (15.3%).

As an S Corp, you split your income into:

Salary (which is taxed like regular income)

Profit Distributions (which aren’t subject to self-employment tax)

Let’s say your business earns $100k. You pay yourself a $35k salary. That gets taxed normally. Then you take $65k as a distribution — and skip the 15.3% SE tax on that part.

That’s about $10k in tax savings. Every year.

BUT... To do it legally, you have to:

Elect S Corp status (usually by March 15)

Run payroll through a provider

Pay yourself a "reasonable salary"

What’s reasonable? Usually around 30-35% of gross revenue. But talk to your accountant.

And yes, you can take distributions throughout the year, then catch up the payroll at year-end as long as the taxes are paid correctly.

Повторяем попытку...

Доступные форматы для скачивания:

Скачать видео

-

Информация по загрузке: